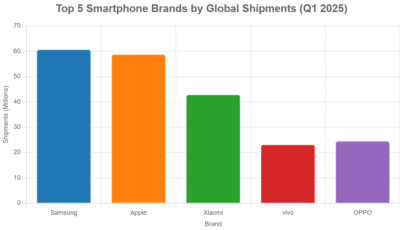

Based on the latest available data for global smartphone shipments in Q1 and Q2 2025, here are the top smartphone brands by global shipments, primarily drawn from reports by Canalys, IDC, and Counterpoint Research. Note that exact figures vary slightly across sources due to differences in methodology, but the rankings are consistent.

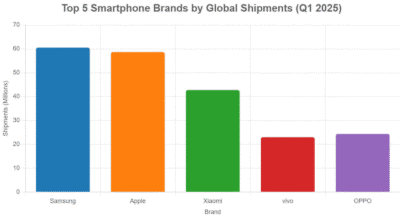

Top Smartphone Brands by Global Shipments (Q1 2025)

Samsung:

- Shipments: ~60.5–60.6 million units

- Market Share: ~20%

- YoY Growth: +2.2% to +7.9%

- Key Drivers: Strong performance of Galaxy A-series (e.g., A36, A56) and flagship Galaxy S25 series, with growth in emerging markets and the U.S. due to tariff-driven inventory frontloading.

Apple:

- Shipments: ~55–58.7 million units

- Market Share: ~18–19.3%

- YoY Growth: -9.6% to +10%

- Key Drivers: Record Q1 shipments in some metrics, driven by iPhone 15 and 16 series, though performance in China weakened due to subsidy exclusions and competition. Growth in the U.S. and India was notable.

Xiaomi:

- Shipments: ~41.8–42.8 million units

- Market Share: ~13.7–14.1%

- YoY Growth: +0.6% to +33.8%

- Key Drivers: Strong presence in India, Latin America, and Central Europe, with competitive pricing and AI-integrated devices like Redmi and POCO series.

- vivo:

- Shipments: ~22.6–23.0 million units

- Market Share: ~7.4–8%

- YoY Growth: +6.3% to +7.1%

- Key Drivers: Growth in India and China, fueled by mid-range Y and T series and events like China’s 618 festival.

OPPO:

- Shipments: ~22.7–24.4 million units

- Market Share: ~7.7–8%

- YoY Growth: -8.6% to -7.3%

- Key Drivers: Solid entry-level performance with models like A5 Pro, but struggles with high-end transformation and international market declines.

Additional Notes

- Q2 2025 Trends: Global shipments ranged from 288.9 million (Canalys) to 295.2 million (IDC), with growth of 0% to 2% YoY. Samsung led with 57.5–58 million units, followed by Apple (44.8–46.4 million), Xiaomi (42.4–42.5 million), vivo (26.4–27.1 million), and Transsion (24.6–25.1 million). Transsion saw declines in Q2 but was notable in Q1 for 85% YoY growth, especially in Africa.

- Emerging Players:

- Transsion (Infinix, Tecno, iTel): Strong in Africa and South Asia with affordable 5G models, but faced Q2 declines.

- Huawei: A dark horse with 15.75 million units in Q1 (+28% YoY), driven by Kirin chips and Mate/P series in China.

- Motorola: Grew 16% YoY in Q2, driven by India and North America’s prepaid market.

- Nothing: Grew 177% YoY in Q2, surpassing 1 million units, led by India.

- Market Dynamics: Growth was modest due to weak demand in China, tariff impacts, and economic uncertainty. Emerging markets like India, Africa, and Latin America drove growth, while mature markets focused on premium devices. AI features, foldables, and 5G adoption were key trends.

Chart of Top 5 Smartphone Brands by Shipments (Q1 2025)

Sources

Data compiled from Canalys, IDC, Counterpoint Research, and other reports for Q1 and Q2 2025.